santa clara property tax rate 2021

The bills will be available online to be viewedpaid on the same day. The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate.

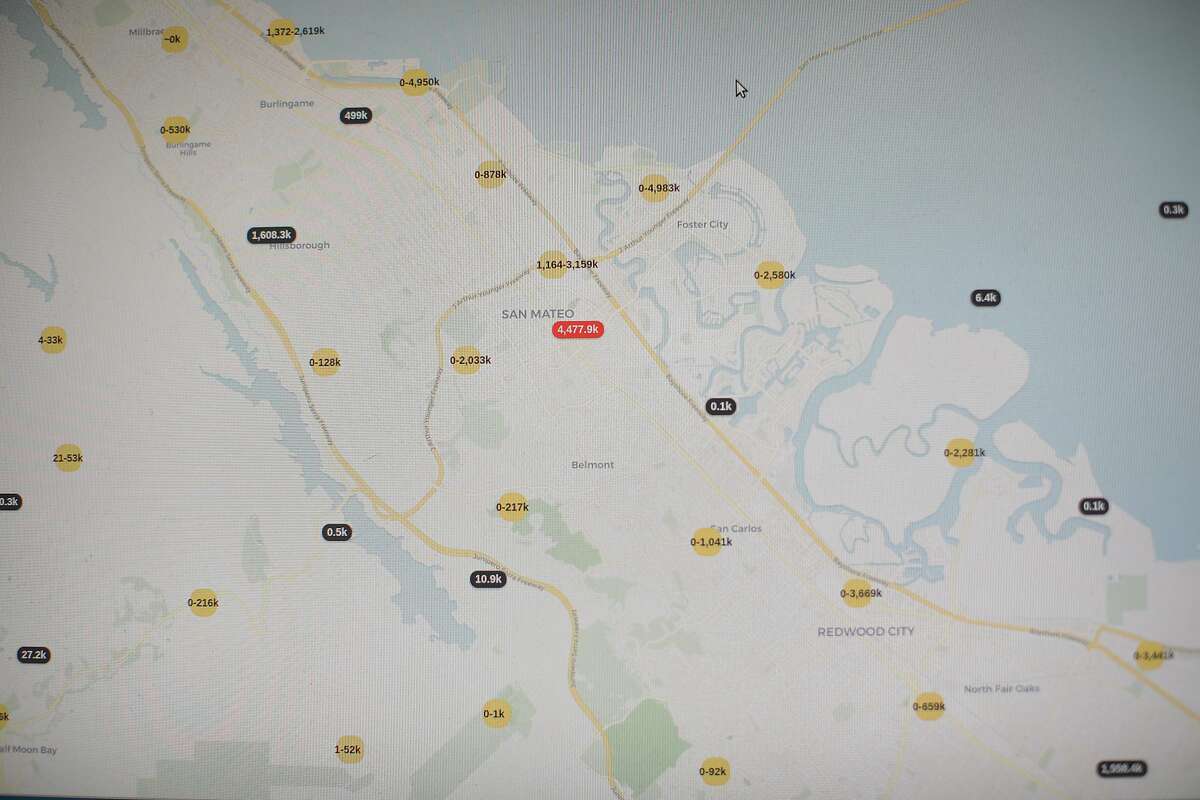

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

The bills will be available online to be viewedpaid on the.

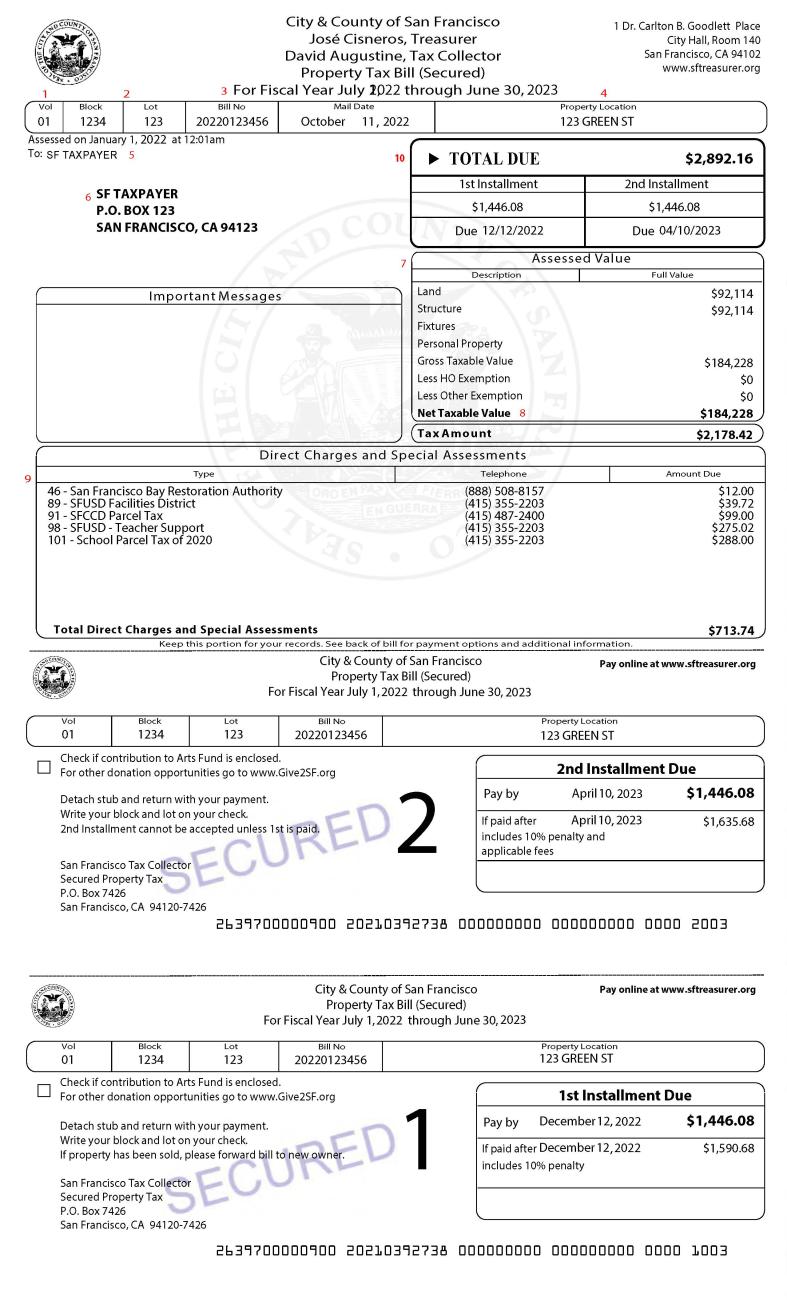

. The chart shows the Countywide distribution of the 1. This report shows the allocation of property tax in Santa Clara County for your tax rate area. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

1788 rows Santa Clara. The minimum combined 2022 sales tax rate for Santa Clara California is. All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis.

Property Taxes are made up of. County of Santa Clara Department of tax collections. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

067 of home value Yearly median tax in Santa Clara County The median property tax in Santa Clara. Elements of Property Taxes. The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021.

Santa Clara County California Property Tax Go To Different County 469400 Avg. This is the total of state county and city sales tax rates. The bills will be available online to be viewedpaid on the.

Search Unclaimed Monies Property Tax Refunds. Santa Barbara campus rate. SCC Tax The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

1 assessed-value property tax. The average effective property tax rate in Santa Clara County is 073. Santa Clara County has one of the highest median property taxes in the United States.

As of June 18 2021 the internet website of the California Department. Yearly median tax in Santa Clara County. Santa Clara Valley Water District North Central Zone.

Effective April 1 2021 Proposition 19 permits eligible homeowners defined as over 55 severely disabled or whose homes were destroyed by wildfire or disaster to transfer their primary. September 2021 Publication - Notice of Tax Defaulted Delinquent. The median property tax in Santa Clara County California is.

What is the sales tax rate in Santa Clara California. Higher sales tax than 75 of California localities 0375 lower than the maximum sales tax in CA The 9125 sales tax rate in Santa Clara consists of 6 California state sales tax 025 Santa. Owners must also be given an appropriate notice of rate.

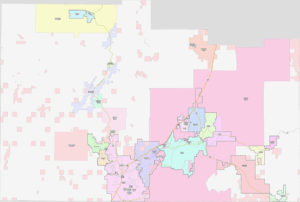

Los Angeles Property Tax Which Cities Pay The Least And The Most

Prop 19 Property Tax And Transfer Rules To Change In 2021

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog

Property Values And Property Taxes Washington County Of Utah

Santa Clara Elementary School Sunnyside Unified School District

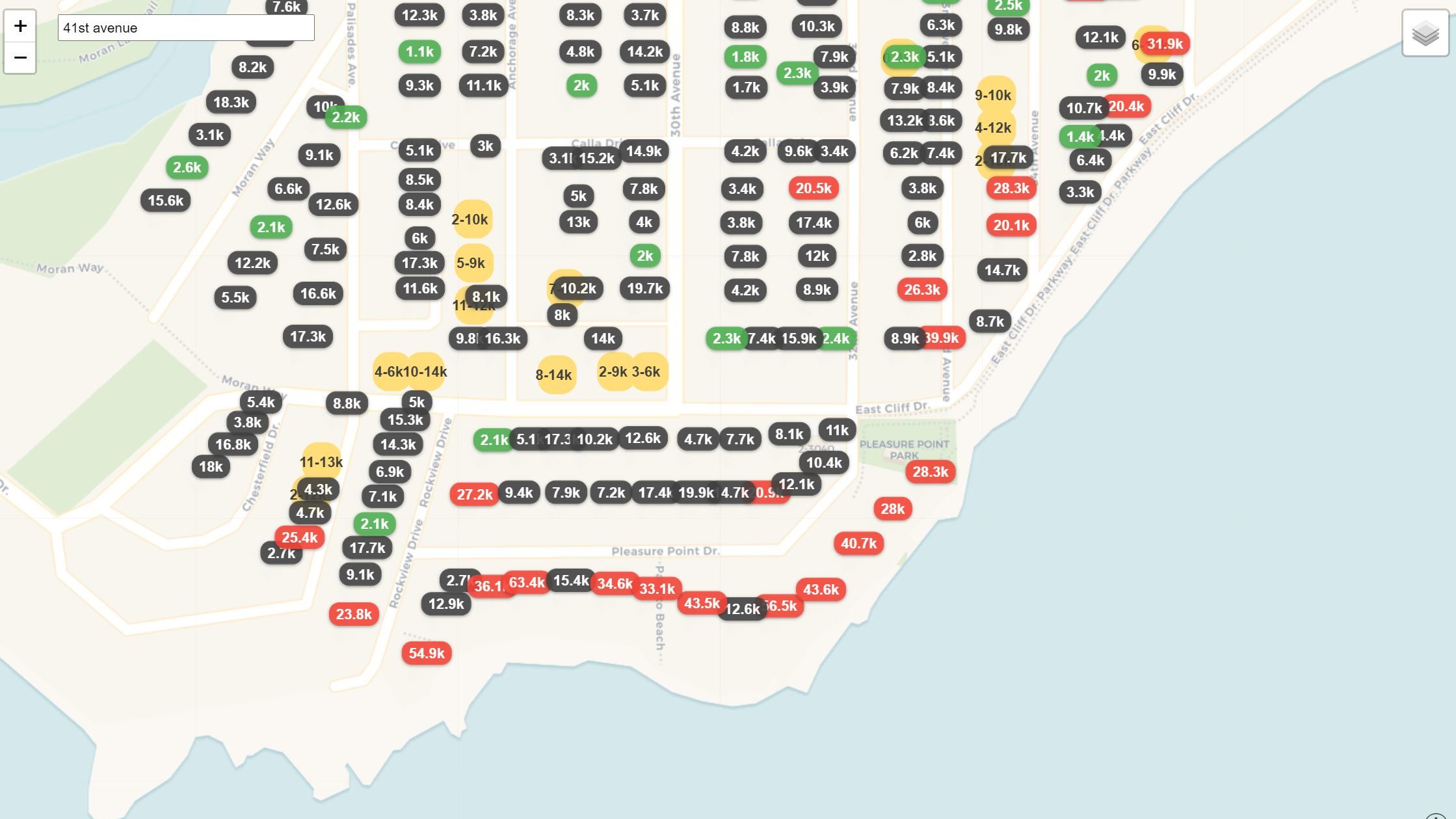

Bay Area Cities Where Homeowners Saved Up To 30k On Property Taxes In Real Estate Boom

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

Bay Area Property Tax Roll Jumps To 1 8 Trillion Ke Andrews

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Some Santa Clara County Workers Return To The Office San Jose Spotlight

Secured Property Taxes Treasurer Tax Collector

California Sales Tax Guide For Businesses

Understanding California S Property Taxes

Santa Clara County Home Prices Market Conditions Compass

Maps Show Disparity In Santa Cruz County Property Taxes Santa Cruz Local

Measure E Transfer Tax In San Jose Valley Of Heart S Delight Blog